THE MARKET – Construction material in Iraq

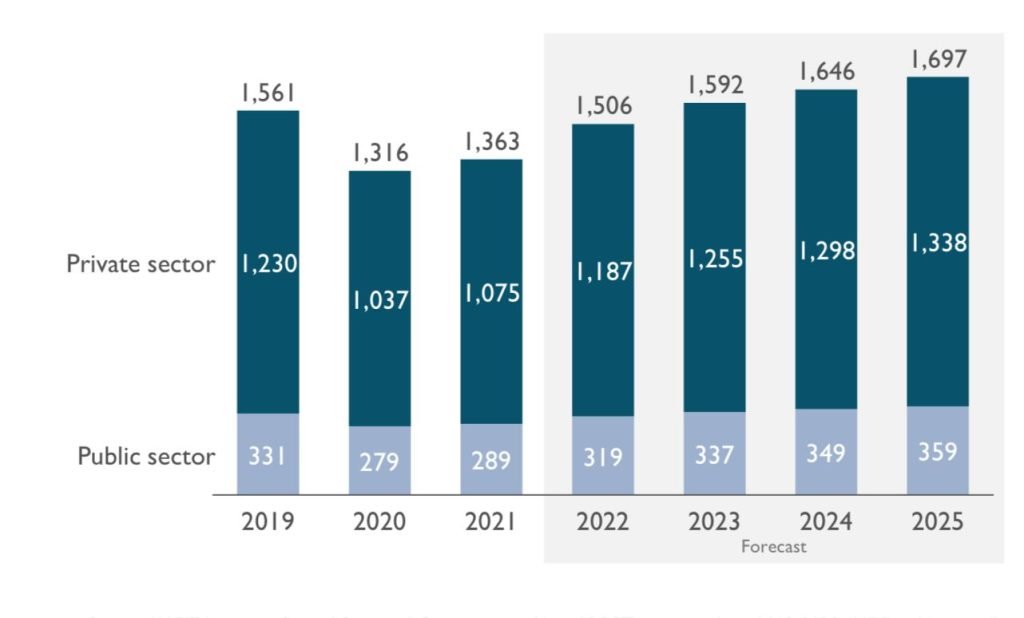

The value of Iraq’s building sector stands at ~US$1.5B per year, driven primarily by residential developments and public infrastructure. Underlying this growth in the sector is a steady uptick in residential real estate developments and increased government investment in building projects (e.g., public housing schools, and hospitals). Furthermore, Iraq’s broader reconstruction needs after years of conflict are manifold: the World Bank estimates that Iraq’s deficit in houses, schools, and hospitals alone stands at nearly US$25B.

Figure 1. Iraq estimated building sector size, US$M

THE PROJECT – Gypsum mine and factory

ATS is developing a vertically integrated gypsum mine and factory in Anbar Province, Iraq with an investment size of US$63.8M, US$10M of which would fund initial working capital. The mine site, rich with raw calcium sulfate deposits, is located on 2.5M square meters in Hit, while the factory will occupy a 500K square meter plot outside Ramadi, 135 kilometers from Baghdad and only 40 kilometers from the planned site for the Anbar International Airport. The factory will produce gypsum powder, wallboard, ceiling boards and their accompanying metal parts. At capacity, ATS expects to produce 600K tons of gypsum powder, 40M square meters of wallboard, 5M square meters of ceiling tiles, and 21.6M metal parts.

Using the services of a contractor, the company will extract raw calcium sulfate from the mine, crush the raw material, and transport it to the factory, where it will be converted to gypsum powder. From there, factory employees will process the powder into wallboard (standard, fire-resistant, and moisture-resistant ratings) and ceiling board. The factory will use state-of-the-art machinery from international companies Ventomatic and Huihang. Moreover, ATS has secured relevant operating permits from the federal and provincial authorities.

Relying on a strong network of local distributors, ATS is targeting end-users (typically real estate developers and independent builders) in both Iraq and the broader MENA region. The factory’s strategic location at the center of the country – and the improved security situation in Anbar – afford it access to key thoroughfares that link the province to key markets in Iraq, the Levant, and the GCC.

The company seeks investment to fund the construction of the factory and the purchase of machinery. The project owners are open to both debt and equity (as well as a joint venture partnership), provided they retain a majority share in the company, and plan to contribute roughly US$4-6M in equity. Crucially, the shareholders of ATS have access to a land grant that would allow them to own the project’s land, which, along with the machinery, could serve as collateral.

Table 1. Investment uses and timeline

| Uses | Value (US$) | Timeline |

| Construction works | 32.2M | Years 1-2 |

| Machinery purchase | 19.6M | Years 1-2 |

| Generator purchase | 2.0M | Years 1-2 |

| Initial working capital | 10.0M | Years 2-3 |

THE IMPACT – Jobs for Iraq’s reconstruction

The project will have a substantial, positive impact on Iraq through both job creation and its contribution to the country’s reconstruction efforts. ATS estimates the creation of over 600 direct and indirect jobs in Anbar Province, in addition to economic opportunities for local contractors. It will also contribute to Iraq’s broader efforts to substitute away from imports and foster domestic manufacturing. Moreover, the project will contribute to the larger goal of post-ISIS reconstruction in Iraq and is the type of project that has the potential to attract internally displaced persons (IDPs) from Anbar to return to the province.